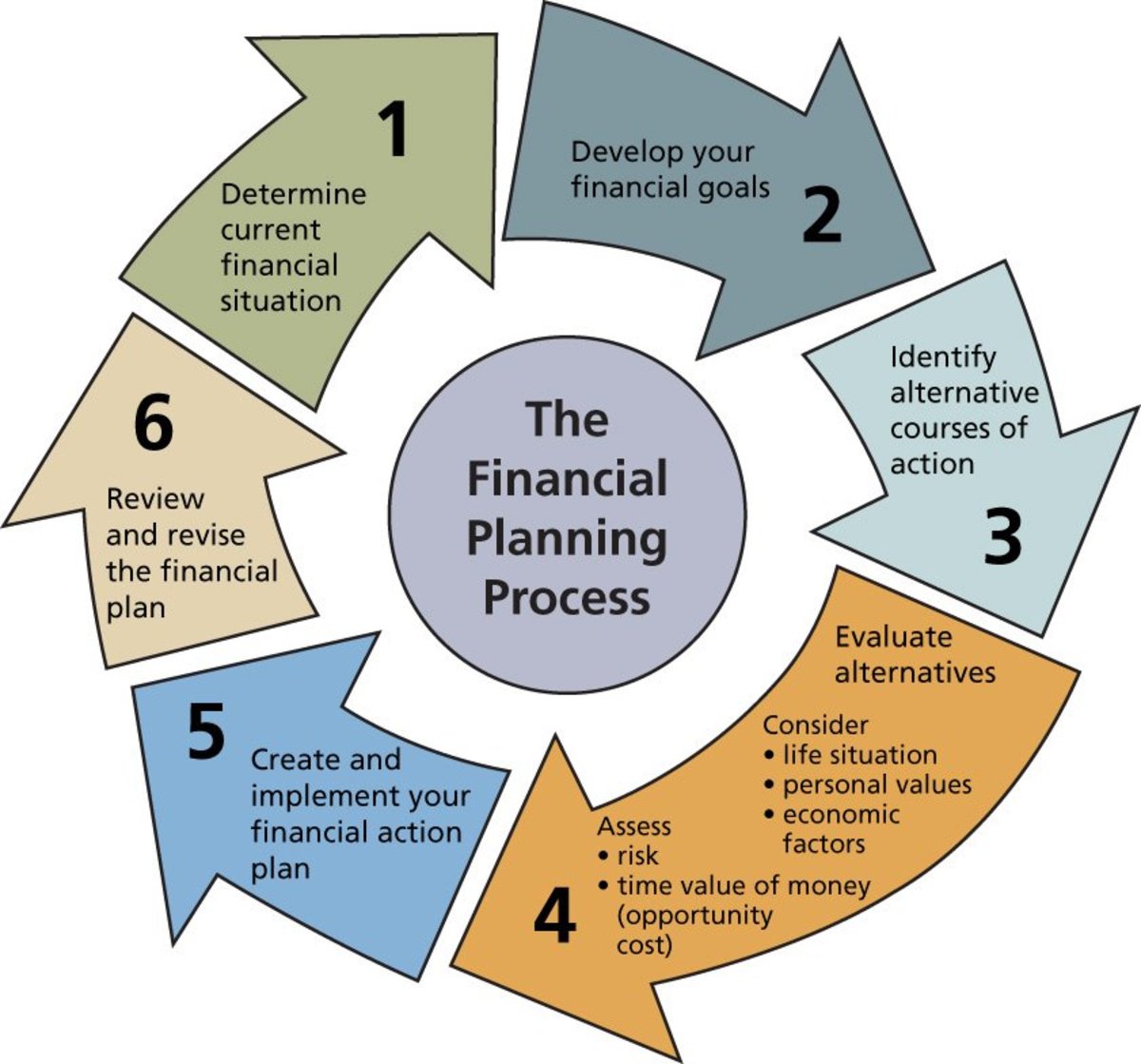

Financial planning plays a crucial role in achieving your financial goals and securing a stable future. It involves carefully analyzing your current financial situation, setting realistic objectives, and devising a strategy to meet those goals.

While some individuals prefer managing their finances independently, others find great value in outsourcing their financial planning.

In this blog post, we will explore the benefits of outsourcing your financial planning in Adelaide Hills and why it may be the right choice for you.

What is Financial Planning?

Before delving into the reasons for outsourcing financial planning, it’s important to understand what financial planning in Adelaide Hills entails. Financial planning involves assessing your income, expenses, investments, and other financial aspects to create a comprehensive strategy to meet your short-term and long-term financial goals.

It covers areas such as budgeting, saving, investment planning, tax planning, retirement planning, and risk management.

Time and Expertise

One of the primary reasons to consider outsourcing your financial planning is to save time and leverage the expertise of professionals. Financial planning requires a deep understanding of various financial instruments, tax laws, investment strategies, and risk management techniques.

By outsourcing this responsibility to a financial planner, you can free up valuable time to focus on other important aspects of your life or business.

Objective Perspective and Customized Solutions

When you handle your own financial planning, it’s easy to become emotionally attached to your financial decisions. Outsourcing your financial planning provides an objective perspective and allows an expert to assess your financial situation without any emotional bias.

Financial planners can analyze your unique circumstances and create customized solutions tailored to your specific goals, risk tolerance, and timeline. Their expertise helps in maximizing returns, minimizing risks, and optimizing your financial strategies.

Access to Specialized Knowledge

Financial planning involves staying updated with the latest trends, regulations, and investment opportunities. Professional financial planners possess specialized knowledge and insights in various financial areas.

By outsourcing your financial planning, you gain access to this expertise, which can help you make informed decisions and navigate complex financial landscapes.

Whether it’s understanding the implications of tax law changes or identifying emerging investment opportunities, a financial planner can guide you through the ever-changing financial landscape.

Emotional Discipline and Accountability

One common challenge in financial planning is maintaining emotional discipline and sticking to your financial goals during turbulent times. A financial planner acts as a source of accountability, helping you stay on track and avoid making impulsive decisions driven by fear or greed.

They provide guidance and support during market fluctuations, ensuring that you stay focused on your long-term objectives. This emotional discipline can significantly enhance your financial success and reduce the likelihood of costly mistakes.

Conclusion

Outsourcing your financial planning can offer numerous benefits, including saving time, leveraging expertise, gaining an objective perspective, accessing specialized knowledge, and maintaining emotional discipline.

While some individuals may prefer to manage their finances independently, others find great value in partnering with a financial planner to achieve their financial goals. Ultimately, the decision to outsource financial planning in Adelaide Hills depends on your unique circumstances, goals, and preferences.

However, if you seek professional guidance, customized solutions, and a comprehensive approach to financial management, outsourcing your financial planning may be a prudent choice.